Antifragile:

Things That Gain From Disorder

On this page:

⭐ Key Notes

- Protect yourself from extreme harm and let positive black swans take care of themselves.

- Volatility is information.

- No opinion without risk, and no risk without hope for return.

- Never ask anyone for their opinion, forecast, or recommendation. Just ask what they have, or don’t have, in their portfolio.

Book I: The Antifragile

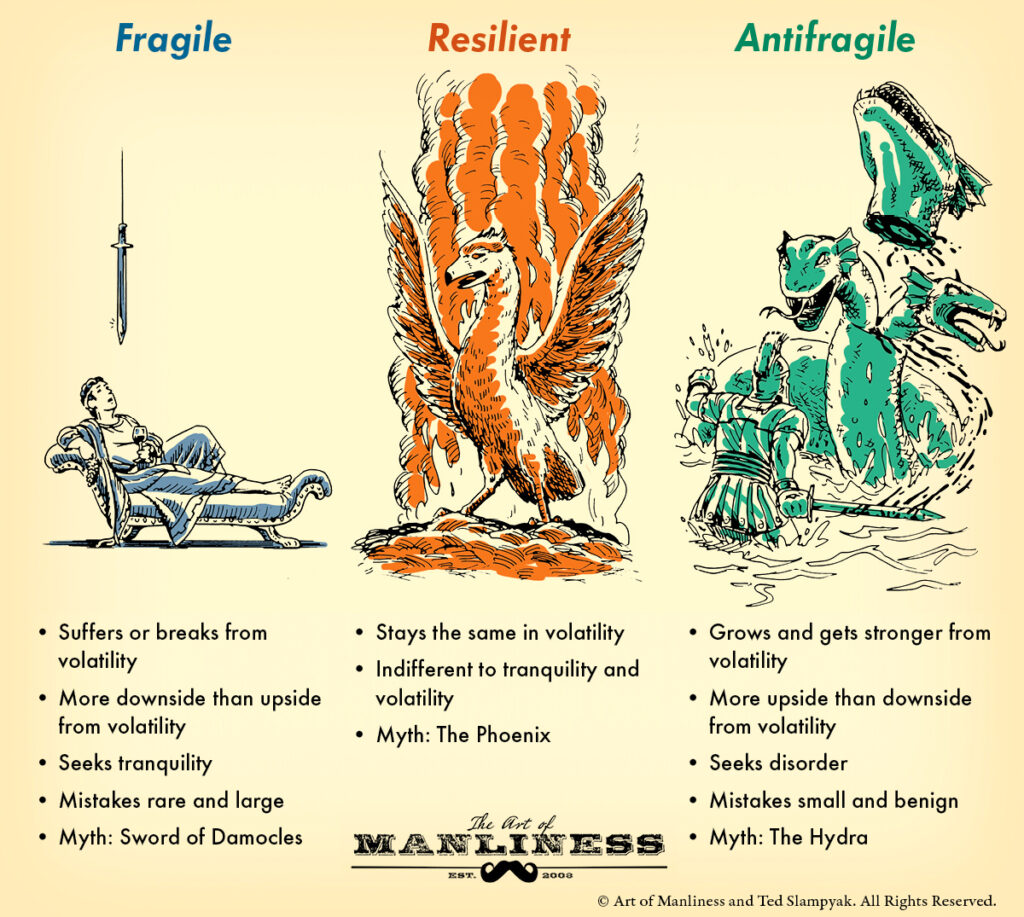

🐍 Chapter 1: between Damocles and Hydra

- Fragility

- Damocles dines with a sword dangling over his head.

- The slightest stress to the string would kill him.

- Robustness

- The Phoenix dies and is reborn from its ashes.

- It returns to the same state after a massive stressor.

- Antifragility

- When one head of the Hydra is cut off, two grow back.

- Mithridatization

- The result of an exposure to a small dose of a substance that, over time, makes one immune to larger quantities.

- Nature is a recurring antifragility

- When you lift weights, your body adapts to lift heavier weights.

- Streisland effect

- The desire to kill an idea can directly lead to its proliferation.

- Banned books become more popular.

👔 Chapter 2: overcompensation and overreaction everywhere

- If you need something done, give it to the busiest person.

- To estimate the quality of research – take the caliber of the highest or lowest detractos, whom the author answers in print.

- People who do not seem to care how they dress or look are robust or antifragile.

- People who wear suits and worry about reputation are fragile.

- Lucretius problem

- We consider the biggest object that we have seen in our lives or heard about, and consider it as he largest item that can possibly exist.

🏹 Chapter 3: the cat and the washing machine

- Everything that has life, is to some extent antifragile.

- Complex systems – have many interdependencies.

- Causal opacity

- it is hard to see the arrow from cause to consequence.

- Many conventional methods of analysis are inapplicable.

- The predictability of specific events is low, due to such opacity.

- Due to nonlinearities, we need higher visibility.

☠ Chapter 4: what kills me makes others stronger

- The fragility of every startup is necessary for the economy to be antifragile.

- Random stressors help species evolve quickly and improve.

- Errors are valuable as long as they are made in isolation and learned from.

- He who has never sinned is less relable than he who has only sinned once.

- Someone who has made many errors, though never the same error repeatedly, is most reliable.

- Failure of individual agents is necessary for the whole to improve.

Book II: Modernity and the Denial of Antifragility

🦃 Chapter 5: the souk and the office building

- Volatility

- Volatility is information.

- Silent risks accumulate beneath the surface, in systems with minimal variability.

- Artificially constrained systems become prone to black swans.

- The great turkey problem

- A turkey is fed for a thousand days by a butcher.

- Every day confirms that butchers love turkeys with increased statistical confidence.

- The butcher will keep feeding the turkey until thanksgiving.

- The turkey will have a revision of belief as its confidence is maximal.

- Mistaking absence of harmful evidence for evidence of absence.

🐎 Chapter 6: tell them I love (some) randomness

- Buridan’s donkey

- A donkey equally famished and thirsty, caught at an equal distance from food and water will unavoidably die from hunger and thirst, unable to make a decision between the two.

- He can be saved by a random nudge in either direction.

- Randomness can help with decision making by acting as a stressor.

- No stability without volatility

- The longer one goes without market trauma, the worse the damage when commotion occurs.

- When volatility is artificially suppressed, the system exhibits no visible risks.

- Seeking stability has been a great sucker game for economic and foreign policies.

💉 Chapter 7: naive intervention

- Iatrogenics

- Means caused by the healer

- Net loss – damage from treatment outweighs the benefits.

- Damage is usually hidden or delayed.

- We have a predisposition to do something instead of nothing. Even when doing nothing is the better option.

- We create fragile systems in our attempt to reduce short-term volatility.

- It is easier to sell look what I did rather than look what I avoided for you.

- It is not linear. We should not take risks with near-healthy people, but should take great risks with those in danger.

- Naive interventionism

- We tend to over-intervene in areas with minimal benefits and large risks.

- We often under-intervene in areas where it is necessary, such as emergencies.

- Intervening to limit size, concentration, and speed are beneficial to reducing black swan risks. For example, limit the size of companies.

- The best way to mitigate intervensionism is to ration the supply of information.

- People fall under the illusion that science means more data.

- More data often leads to less understanding and more iatrogenics.

- Procrastination

- Procrastination is a message from our natural willpower via low motivation.

- The cure is changing the environment, or profession.

- Select an environment where you do not have to fight your impulses.

- Few can grasp the logical consequence that, we should lead a life in which procrastination is good.

- Agency problem

- One party has personal interests that are divorced from those of the principal.

- Catalyst-as-cause confusion

- Catalysts are often confused for causation.

- Political and economic tail events are unpredictable and not scientifically measurable.

- No matter how many dollars are spent, politics and exonomics is not tractable randomness, like blackjack.

🎲 Chapter 8: prediction as a child of modernity

- Providing someone with a random numerical forecast increases risk taking

- Even if the person knows that the projections are random.

- Redundancy is nonpredictive

- If you have excess cash in the bank, you do not need to know with precision which event will cause potential difficulties.

- The margin of safety avoids optimisation and removal of our sensitivity to risk.

Book III: A Nonpredictive View of the World

✈ Chapter 9: Fat Tony and the fragilistas

- Fat Tony heuristics

- Focus on actions and avoid words.

- Never get on a plance if the pilot is not on board.

- Make sure there is also a copilot.

- Transfer of fragility

- People voting for war need to have at least one dependent exposed to combat.

☔ Chapter 10: Seneca’s upside and downside

- Stoicisim

- Stoicism makes you desire the challenge of a calamity.

- Stoics look down on luxury and lavish lifestyles.

- He is in debt, whether he borrowed from another person or from fortune

- Stoicism is pure robustness.

- Attainment of a state of immunity from external circumstances.

- Absence of fragility to decisions made by fate.

- Random events will not affect us either way.

- Assymetry of success

- With success, you have more to lose than to gain.

- If I have nothing to lose, then it is all gain and I am antifragile.

- Transform fear into prudence, pain into information, mistakes into initiation, and desire into undertaking.

- Emotional positioning

- Mental write off belongings to not feel any pain from losses.

- Assume every morning that the worst possible thing had actually happened. Rest of the day will be a bonus.

- It is hard to stick to discipline when things are going well.

🏋🏼♂️ Chapter 11: never marry the rockstar

- Seneca’s barbell

- The barbell illustrates the idea of a combination of extremes kept seperate, with avoidance in the middle.

- It is a bimodal strategy – two distinct modes, rather than a single central one.

- Antifragility is the combination of aggressiveness plus paranoia.

- Protect yourself from extreme harm and let positive black swans take care of themselves.

- Play it safe in some areas and take a lot of small risks to expose to positive extreme events.

Book IV: Optionality, Technology, and the Intelligence of Antifragility

- Teleological Fallacy

- The illusion that you know exactly where you are going, and that you knew exactly where you were going in the past, and that others have succeeded by knowing where they were going.

- Birds do not need to understand the mathematics of flights in order to fly.

- Master-pupil relationships develop because the people were like-minded in the first place.

🍇 Chapter 12: Thales’ sweet grapes

- Things that like dispersion

- The more options you have, the more freedom to respond to unforseen circumstances.

- An option does not care about average outcomes, only favourable ones.

- Authors and artists are much better off having a small number of fanatics, rather than a large number of appreciators.

- Growth in society may not come from raising the averages, but from increasing the number of people in the tails – those endowed with rare courage and imagination.

- All you need is the wisdom to not do unintelligent things to hurt yourself.

- Option = asymmetry + rationality

- The rationality lies in keeping what is good and ditching the bad – know when to take profits.

- Rules for optionality

- Look for optionality and rank things according to their optionality.

- Look for things with open ended profits, not closed ended.

- Do not invest in business plans, but in people who could change careers six or seven times.

- Make sure you are barbelled.

- Tinkering

- Trial and error is a great way to figure things out and expose yourself to large potential upsides.

- Many great inventions were originally created as toys or for amusement.

🐤 Chapter 13: lecturing birds how to fly

- Soviet-Harvard illusion

- Academia -> applied science -> practice

- This model is valid for very narrow situations, such as building an atomic bomb.

- Naive rationalism leads to overestimating the role and necessity of academic knowledge.

- For complex domains, an alternative process would be better, such as looped tinkering.

- Tinker -> heuristic -> practice -> tinker -> heuristic -> practice.

🔀 Chapter 14: when two things are not the “same thing”

- Causal arrow

- Is it true that lecture-driven knowledge leads to prosperity?

- Empirical evidence suggests no evidence that raising general level of education raises the income of a country.

- On the opposite side – wealth leads to the rise of education.

- Observe which direction the causal arrow is travelling.

- Prometheus and Epimetheus

- The narrative is instrumental, although not epistemological.

- Religious stories might not have value as narratives, but they may get you do something antigragile and mitigate risks.

- Expert problems bring fragilities – the expert knows a lot, but less than he thinks.

- When you are fragile, you need to know a lot more than when you are antifragile.

- Acceptance of ignorance can reduce fragility.

- Green Lumber fallacy

- One mistakes a source of necessary knowledge for another less tractable source.

- People with too much smoke and complicated tricks start missing the elementary.

- A trader once made considerable profit by trading lumber that he thought was painted green.

- In reality, he was trading fresh wood and this fact made no difference to his ability to trade.

🪀 Chapter 15: history written by the losers

- Spend on non-teleological tinkering, not research

- There is no evidence that strategic plans work.

- Money should go to tinkerers who will milk the options.

- TInkering uncurs a lot of small issues.

- Once in a while, tinkering will expose something significant.

⚽ Chapter 16: a lesson in disorder

- The soccer mom problem

- She attempts to remove all randomness and uncertainty from her children and protect them.

- In doing so, she prevents them from developing the ability to bounce back and adapt to difficulties.

- Trial and error helps children develop and learn.

- Adventure, uncertainty, and self-discovery make life worth living.

🦍 Chapter 17: Fat Tony debates Socrates

- Primal instincts

- If I asked someone riding a bicycle to give me the theory behind it, he would fall from it.

- By bullying and questioning people, you confuse and hurt them.

- Follow habitsm instincts, and traditions.

- Justifying every action may be right occasionally, but it is more likely to confuse the right course of action.

- Embrace the joy of ignorance.

- Things are too complicated to be expressed in words.

- Focus on the payoff

- The consequential benefit or harm is more important than the event itself.

- Philosophers conflate truth with risks and rewards.

- Make decisions based on fragility, not probability.

Book V: The Nonlinear and the Nonlinear

🥌 Chapter 18: on the difference between a large stone and a thousand pebbles

- Simple rule to detect the fragile

- For the fragile:

- Shocks bring greater harm as their intensity increases.

- The cumulative effect of small shocks is smaller than the single effect of an equivalent large shock.

- Fragility stems from nonlinear effects.

- A car is fragile – if you drive into a wall at high speed, the damage will be great.

- For the antifragile:

- Shocks bring more benefits as their intensity increases.

- Lifting weights is beneficial in lower reps to build muscle.

- In project management – increasing the size per segment of a project leads to higher costs and delays.

- If I throw a large stone at a aperson, it will cause more harm than a thousand tiny pebbles.

- For the fragile:

- Why planes don’t arrive early

- Travel time cannot be negative.

- Uncertainty tends to cause delays.

- Arrival time decreases by minutes, whereas delays increase by hours.

- Unexpected shocks typically increase complexity, not reduce them.

- 98% of contemporary projects have overruns.

🌊 Chapter 19: the philosopher’s stone and its inverse

- Positive and negative model error

- Triad:

- Things that like disturbances or errors (Hydra)

- Things that are neutral (Phoenix)

- Things that dislike disturbance (Domacles)

- Evolution and discovery like disturbances.

- Forecasts and travel time are harmed by errors.

- Make a small change in the assumptions and observe how large the effect is.

- Acceleration of an effect implies that the model can blow up from black swan effects.

- Triad:

- How to lose a grandmother

- Variability is more important than the average.

- Average is of no significance when one is fragile to variations.

- The dispersion in possible outcomes is much more important.

- Observe the convexity effect.

- Never cross a river that is, on average, four feet deep.

- Jensen’s inequality

- If you have favourable asymmetries or positive convexity, then you will do well in the long-run and outperorm the average.

- The greater the uncertainty, the more you will outperform.

- You can be dumb and antifragile and still do very well.

- Someone with a linear payoff would need to be right more than 50% of the time.

Book VI: Via Negativa

- The charlatan

- A charlatan will only ever give you positive advice.

- In practice, it is the negative advice that is used by professionals.

- Chess grandmasters win by not losing.

- People become rich by not going bust.

- You reduce most of your personal risks thanks to a small number of measures.

- If we cannot express what something is exactly, we can say something about what it is not.

- Subtractive knowledge

- The greatest contribution to knowledge is removing what we think is wrong.

- Antifragility is reached by not being a sucker.

- We know a lot more about what is wrong than what is right.

- Negative knowledge is more robust to error, than positive knowledge.

- Knowledge grows by subtraction much more than by addition.

- Less is more.

- Obvious decisions require no more than a single reason.

- Bergson’s razor

- A philosopher should be known for one single idea, not more.

⏲ Chapter 20: time and fragility

- Technology is at its best when it is invisible and seamlessly displaces the inherently fragile preceding technology.

- The Lindy effect

- Perishable

- Every additional day in life translates into a shorter additional life expectancy.

- Non-perishable

- Does not have an organic and unavoidable expiration date.

- Oftern has an information aspect.

- Every additional day may imply a longer life expectancy.

- A book that has been in print for forty years can be expected to remain in print for another forty years.

- Perishable

- Treadmill effects

- Impulses to buy new things that will eventually lose their novelty.

- Especially when compared to newer things.

- Fragile objects do not stand the test of time.

- What does not make sense

- If something that makes no sense to you has been around for a very long time – expect it to stick around much longer.

- For example religion to an atheist.

💊 Chapter 21: medicine, convexity, and opacity

- Iatrogenics in medicine

- First principle – benefits are small and visible, yet the costs are large and delayed or hidden.

- Second principle – effects are not linear.

- We should not take risks with near-healthy people.

- Only resort to medical techniques when the health payoff is very large and visibly exceeds any potential harm.

🥑 Chapter 22: to live long, but not too long

- Negativa in medicine

- Telling people not to smoke has been the greatest medical contribution in recent history.

- True wealth is largely subtractive:

- clear conscience

- worriless sleeping

- absence of envy

- good appetite

- physical energy

- Fasting makes food taste better and produce euphoria.

- Walking effortlessly and sleep has great benefits.

🐘 Chapter 23: skin in the game: antifragility and optionality at the expense of others

- Heroism

- Someone elects to bear the disadvantage for the sake of others.

- Opposite of the agency problem.

- A half-man does not take risks for their opinions.

- Hammurabi

- Every opinion maker needs to have skin in the game to protect from harm caused by reliance on his information.

- Anyone producing forecasts or analysis needs to have something to lose from it.

- Build a margin of safety to mitigate asymmetries in the sensitivity to risk.

- No opinion without risk, and no risk without hope for return.

- He who does not stop a crime is an accomplice.

- Stiglitz syndrome

- Never ask anyone for their opinion, forecast, or recommendation. Just ask what they have, or don’t have, in their portfolio.

- Do not ask the doctor what you should do. Ask what he would do in your position.

- Ethics of corporations

- Larger companies are likely in the business of selling wholesale iatrogenics.

💭 Chapter 24: fitting ethics to a profession

- Wealth without independence

- Treadmill effect – you need to make more and more to stay in the same place.

- Greed is antifragile, though its victims are fragile.

- A free man is one who is free with his opinions.

- A free person cannot be squeezed into doing sometihng the would otherwise never do.

- Anyone with an opinion should be invested and harmed if the audience of their opinion are harmed – accountability.

- Data can only be effectively used to debunk via negativa4, not confirm.